How Outsource Loan Processing Can Transform Your Business

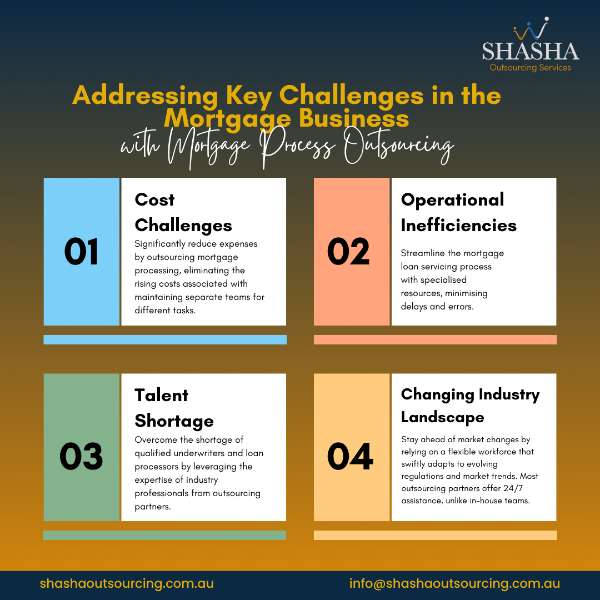

Many businesses today struggle with the sheer volume of paperwork involved in loan and mortgage applications. Managing this paperwork is time-consuming and takes focus away from key areas like sales and client relationships. Outsourcing loan processing can significantly alleviate this burden. By delegating these tasks to experts, businesses can enjoy quicker processing times, greater accuracy, […]

How Outsource Loan Processing Can Transform Your Business Read More »