The Australian mortgage industry is a critical component of the country’s financial ecosystem. However, mortgage brokers are increasingly facing challenges like intense competition, regulatory scrutiny, economic uncertainty, and the growing need for technological adoption. To stay competitive and efficient, many brokers are turning to outsourced mortgage loan processing as a viable solution. In this article, we’ll explore how leveraging services like a loan processing officer or offshore staffing solutions can help Australian brokers navigate these challenges effectively.

Key Challenges Faced by Australian Mortgage Brokers

Mortgage brokers in Australia are grappling with several pain points, including:

- Competition and Commission Pressures: With shrinking profit margins, brokers must optimise operations without compromising service quality.

- Regulatory Compliance: The Royal Commission into financial misconduct has heightened compliance demands, requiring brokers to act in the “best interests” of borrowers.

- Economic Volatility: Fluctuating interest rates and inflation affect borrower confidence and lending volumes.

- Technology Expectations: Clients increasingly expect digital solutions for faster, transparent loan processing.

- Clawback Risks: Early loan discharges can lead to commission clawbacks, impacting brokers’ financial stability.

These challenges necessitate innovative strategies to stay resilient. Outsourcing loan processing services, like those offered by Shasha Outsourcing, has emerged as a game-changing solution

What Are Loan Processing Services?

Loan processing services encompass the administrative and operational tasks involved in securing and finalising loans. A loan processing officer takes on responsibilities such as:

- Document collection and verification.

- Preparing loan files for lender submission.

- Ensuring compliance with legal and regulatory standards.

- Maintaining communication with lenders and borrowers.

By delegating these time-intensive tasks to outsourced mortgage loan processing providers, brokers can focus on their core activities—building relationships and closing deals.

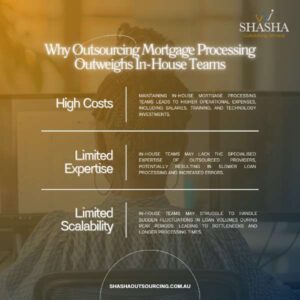

How Outsourcing Reduces Operational Costs

One of the primary benefits of outsourcing is cost savings. Hiring and training in-house staff for loan processing can be expensive, particularly for small to medium-sized brokerages. Offshore staffing solutions offer a scalable and cost-effective alternative. Brokers can pay for processing services on a per-loan basis, ensuring they only incur costs when needed.

For example, Shasha Outsourcing Services, a leader in offshore staffing solutions, provides skilled loan processors at competitive rates, helping brokers maintain profitability even in challenging market conditions.

Enhancing Efficiency and Turnaround Times

Time is money in the mortgage industry. By outsourcing to specialised loan processors, brokers can significantly reduce turnaround times. Experienced professionals handle the intricacies of loan applications, ensuring swift and accurate submissions to lenders.

This efficiency not only improves client satisfaction but also enhances brokers’ reputations in the competitive financial landscape.

Ensuring Compliance with Regulatory Standards

Meeting the stringent compliance requirements in Australia’s mortgage sector can be daunting. Outsourced loan processing officer are well-versed in regulatory frameworks, such as the “best interests duty.” They ensure all applications meet legal standards, reducing the risk of penalties and fostering trust among clients and lenders.

Firms like Shasha Outsourcing have teams of experienced loan processors trained to handle compliance meticulously, minimising risks for brokers.

Managing Economic Volatility with Scalability

Economic uncertainty demands flexibility. Outsourcing provides brokers with the ability to scale operations up or down depending on market conditions. During busy periods, brokers can rely on offshore loan processors to handle increased workloads without committing to permanent hires.

Staying Competitive Through Technology

Outsourcing providers often leverage advanced loan processing tools and platforms. By partnering with firms like Shasha Outsourcing Services, brokers gain access to cutting-edge technology without the need for costly investments. These digital tools streamline loan tracking, document management, and communication, ensuring a seamless process for both brokers and their clients.

Reducing Clawback Risks

Clawbacks occur when a loan is repaid early, leading lenders to reclaim commissions. Outsourced loan processors help mitigate this risk by thoroughly evaluating borrowers’ financial profiles and ensuring loans are tailored to their long-term needs. This diligence minimises the likelihood of early discharges, protecting brokers’ earnings.

Improving Customer Experience

Delegating routine tasks to outsourcing providers allows brokers to focus on personalised client service. By spending more time understanding clients’ needs and offering tailored solutions, brokers can build stronger relationships and enhance satisfaction. Outsourcing ensures the administrative aspects of loans are handled efficiently, leaving brokers free to deliver a superior experience.

Access to Skilled Professionals

Shasha Outsourcing Services prides itself on providing experienced loan processing officers who understand the nuances of the Australian mortgage market. Their expertise in handling diverse loan types and lender requirements ensures brokers can navigate complex cases with ease.

Facilitating Business Growth

For brokers looking to expand their operations, outsourcing offers a scalable solution. Without the need to invest in additional infrastructure or staff, brokers can handle higher loan volumes, enter new markets, and grow their businesses sustainably.

Minimising Errors and Boosting Approval Rates

Errors in loan applications can lead to delays or rejections, damaging client trust. Outsourced professionals specialise in meticulous documentation and compliance checks, ensuring high accuracy. This not only accelerates approval rates but also strengthens relationships with lenders.

Potential Concerns with Outsourcing and How to Address Them

While outsourcing offers numerous benefits, concerns like quality control and communication may arise. Choosing a reputable provider like Shasha Outsourcing Services, with a proven track record and robust onboarding processes, can address these concerns effectively.

Steps to Implement Outsourced Loan Processing

- Identify Needs: Determine which tasks to outsource.

- Research Providers: Evaluate firms like Shasha Outsourcing Services for their expertise and track record.

- Define Processes: Establish clear workflows and expectations.

- Onboard Effectively: Ensure a smooth transition by training the outsourcing team on your unique requirements.

Conclusion

Outsourcing loan processing services provides Australian mortgage brokers with a powerful tool to navigate today’s challenging market. From reducing costs and improving efficiency to enhancing compliance and customer satisfaction, outsourced solutions like those offered by Shasha Outsourcing Services are transforming the industry. By leveraging the expertise of professional loan processing officer, brokers can stay competitive, compliant, and focused on growth.

Shasha Outsourcing Services

101 Overton Road, Williams Landing, 3027, VIC, Australia

03 70464575

[email protected]

FAQs

- What are the primary benefits of outsourcing loan processing services?

Outsourcing reduces costs, improves efficiency, and enhances compliance. - How does outsourcing help with regulatory compliance?

Outsourced professionals ensure applications meet all legal and ethical standards. - Can outsourcing improve loan approval rates?

Yes, by minimising errors and streamlining documentation. - Is outsourcing cost-effective for small-scale brokers?

Absolutely, as it eliminates the need for full-time in-house staff. - How can brokers ensure the quality of outsourced work?

By partnering with reputable providers like Shasha Outsourcing. - What are the risks of outsourcing, and how can they be mitigated?

Risks include quality and communication issues, which can be mitigated by clear contracts and regular performance reviews.